A leadership guide for proving marketing’s business value through ABM metrics

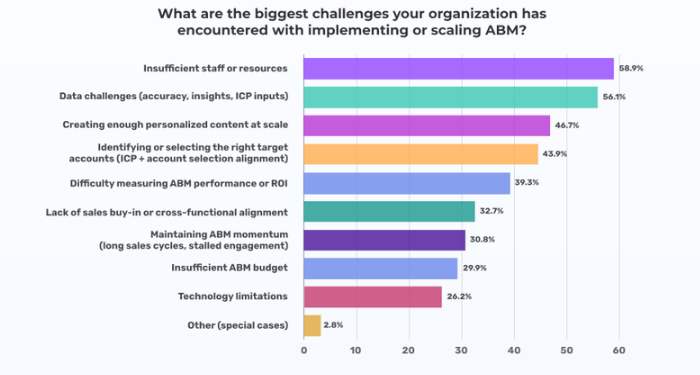

The pressure on marketing leaders to prove revenue impact has never been higher. CFOs expect precision. CROs demand predictability. CEOs want marketing to operate with the same commercial logic used to evaluate sales performance and GTM investments. In this environment, Account-Based Marketing only earns respect when it is communicated as a revenue system, not a sequence of campaigns. But despite ABM’s growing strategic importance, most organizations still struggle to demonstrate impact in a way executives consider meaningful. The State of ABM 2025 data confirms what many teams experience daily: ABM adoption is high, yet consistent, measurable success is rare. People are working hard, but the way impact is communicated doesn’t match how the business measures value.

So what do successful marketers do differently to earn and prove the strategic influence of ABM? There’s one thing they do exceptionally well: they translate marketing outputs into revenue outcomes using the exact language the C Suite uses to make decisions. They know that executives care about three things, in this order:

- Revenue outcomes

- Pipeline momentum

- Engagement quality.

Marketing often flips that order, leading conversations with impressions, clicks, and MQLs metrics disconnected from the business problems executives are trying to solve. When marketing reframes ABM results using the executive hierarchy of evidence, the narrative shifts instantly. Suddenly, marketing is not explaining activity. It is explaining how accounts move, why they move, and what that movement means for revenue.

That clarity begins with a clean, three-level ABM results model.

1. Account engagement: validating targeting and intent through real buyer behavior

At the most foundational level, ABM should prove one thing: that you are engaging the right accounts, and those accounts are demonstrating signals that matter. Not vanity metrics, but meaningful buyer behavior. In most companies, this basic alignment problem appears in daily frustrations. Marketing uploads a target list that’s outdated, sales works a completely different set of accounts, SDRs chase leads with no account context, and leadership can’t tell whether Marketing is influencing the accounts that matter.

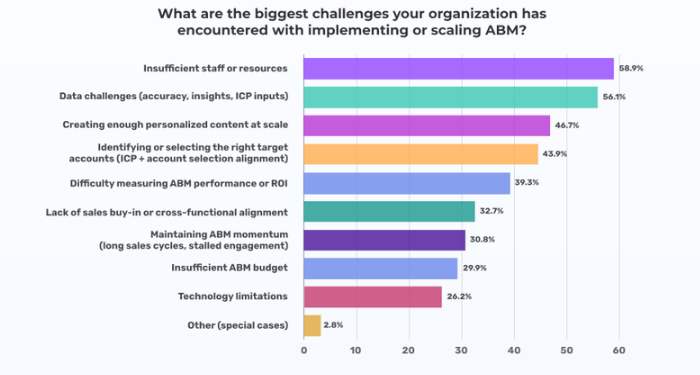

The State of ABM 2025 data reflects this reality: 44% of organizations struggle with ICP precision, and only 31% say Sales and Marketing collaborate effectively on ABM strategy.

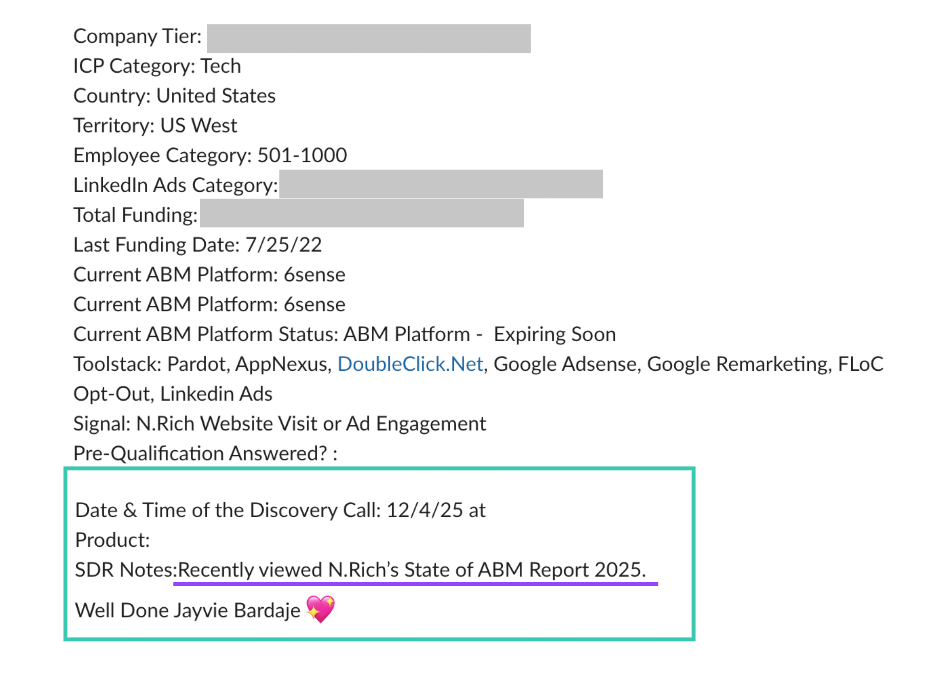

These gaps manifest every day in Slack threads, weekly GTM meetings, and cross-functional planning sessions. When the ICP isn’t operationalized, marketing wastes budget reaching accounts that sales never intended to prioritize, and sales wastes time on accounts that marketing has not warmed or supported.

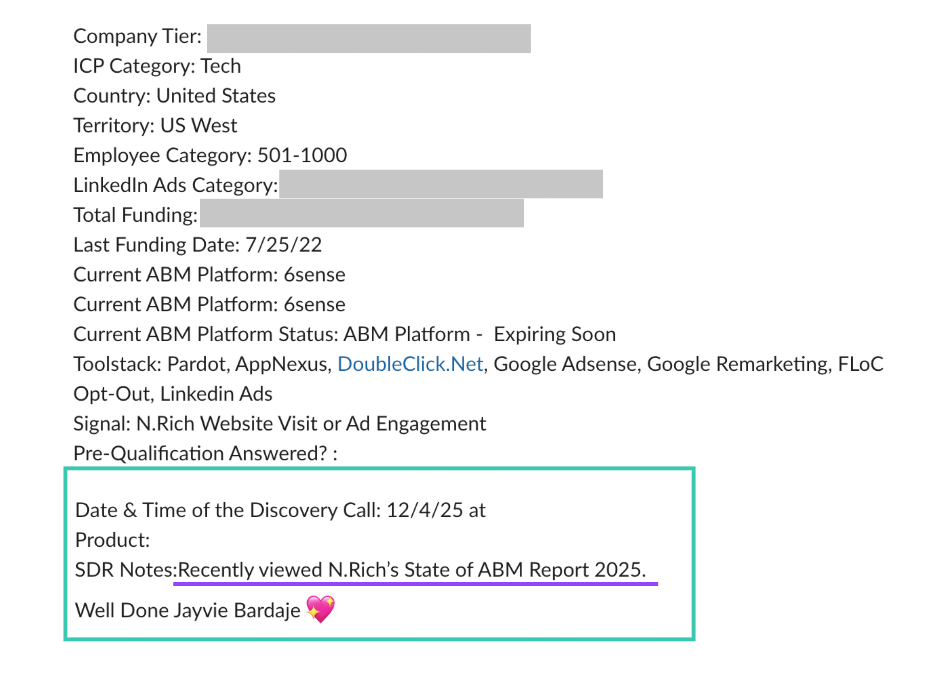

Practical engagement signals that elevate ABM include repeat visits to critical product content, cross-department engagement inside accounts, slow-burn consumption of thought leadership, and region-specific intent patterns. For example, if a Tier 1 US enterprise account is repeatedly viewing attribution and integrations pages, signing up for webinars and downloading gated assets, that tells a fundamentally different commercial story than a buyer scanning top-of-funnel content once a month. Teams should bring these stories into daily standups, pipeline reviews, and campaign planning sessions. That practical narrative: “this account’s behavior tells us they are activating internally” is far more valuable than reporting impressions.

2. Pipeline influence: demonstrating commercial momentum in ways sales leaders feel immediately

While engagement validates direction, pipeline validates impact. This is the moment where ABM begins speaking the CRO’s language.

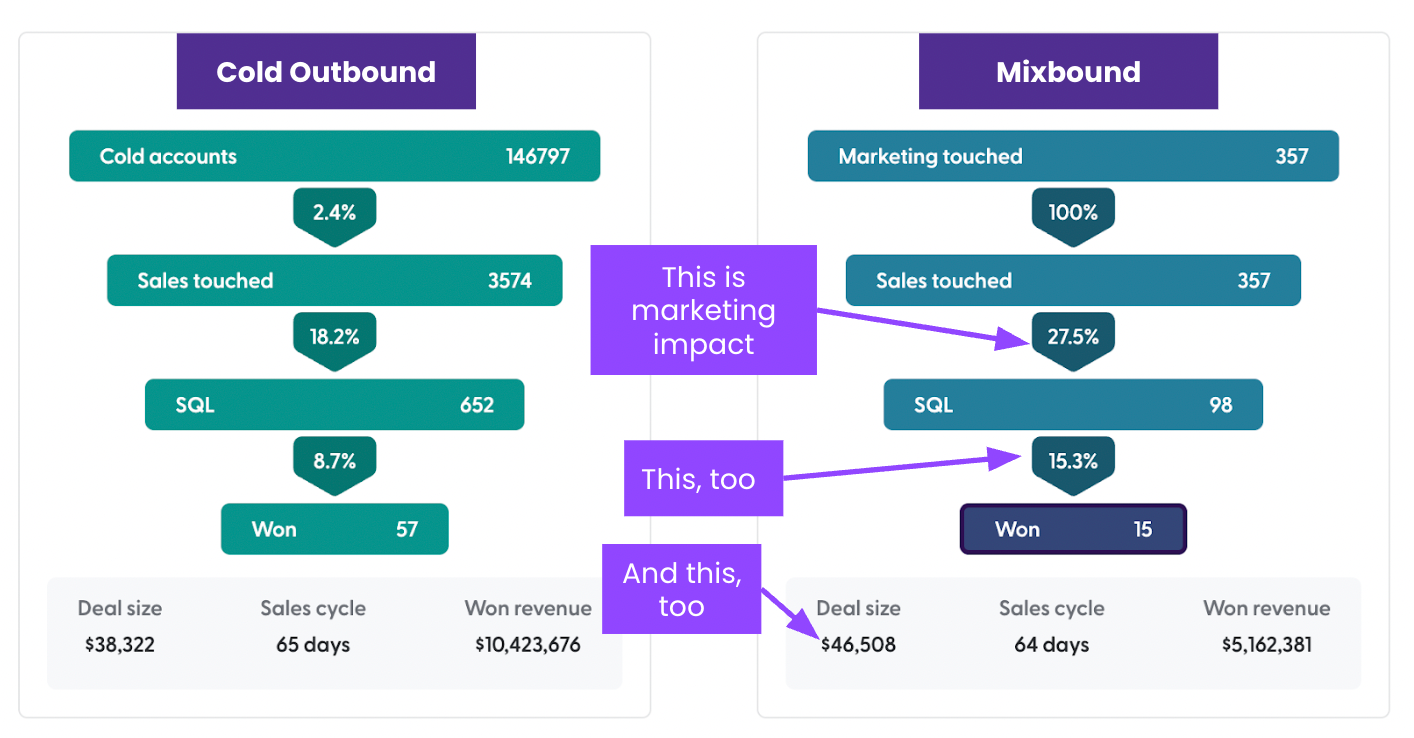

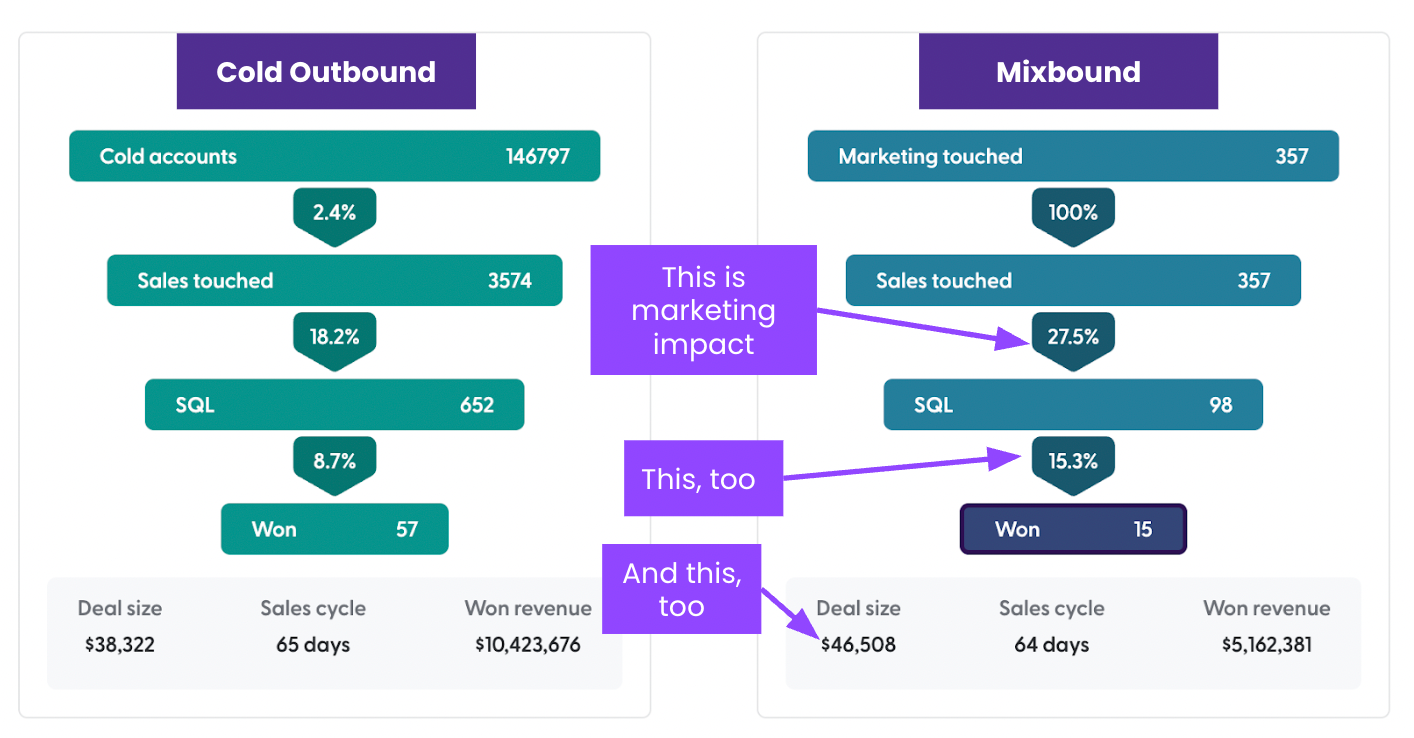

On a day-to-day level, pipeline influence is visible in SDR workflows, weekly opportunity reviews, forecasting discussions, and stage acceleration patterns. The most practical question every sales leader asks is: Do ABM-engaged accounts convert more predictably and more efficiently than cold accounts?

Marketing teams often underestimate how powerful this comparison is inside a revenue organization. Instead of reporting engagement numbers, imagine presenting to the CRO:

- “Accounts with ≥3 meaningful engagement events convert to meetings at 2.3× the rate of cold outbound.”

- “ABM-warmed accounts move from Stage 1 to Stage 2 in an average of 12 days vs. 28 days for cold accounts.”

- “SDRs booked 40% more meetings when prioritizing ABM-engaged accounts.”

These are the kinds of insights that directly influence how SDR managers coach their teams, how AEs prioritize territories, and how CROs allocate resources. And the data backs up the need for this shift: although 77% of organizations report increased pipeline from ABM, only 26% consider their programs successful. That means teams are generating movement, but not momentum.

Pipeline influence becomes tangible when ABM intelligence guides daily decisions. SDR teams stop “smiling and dialing” blindly. AEs walk into calls with context about what the account cared about before the conversation even began. Marketing finally stops debating attribution and instead demonstrates how its actions change commercial behavior.

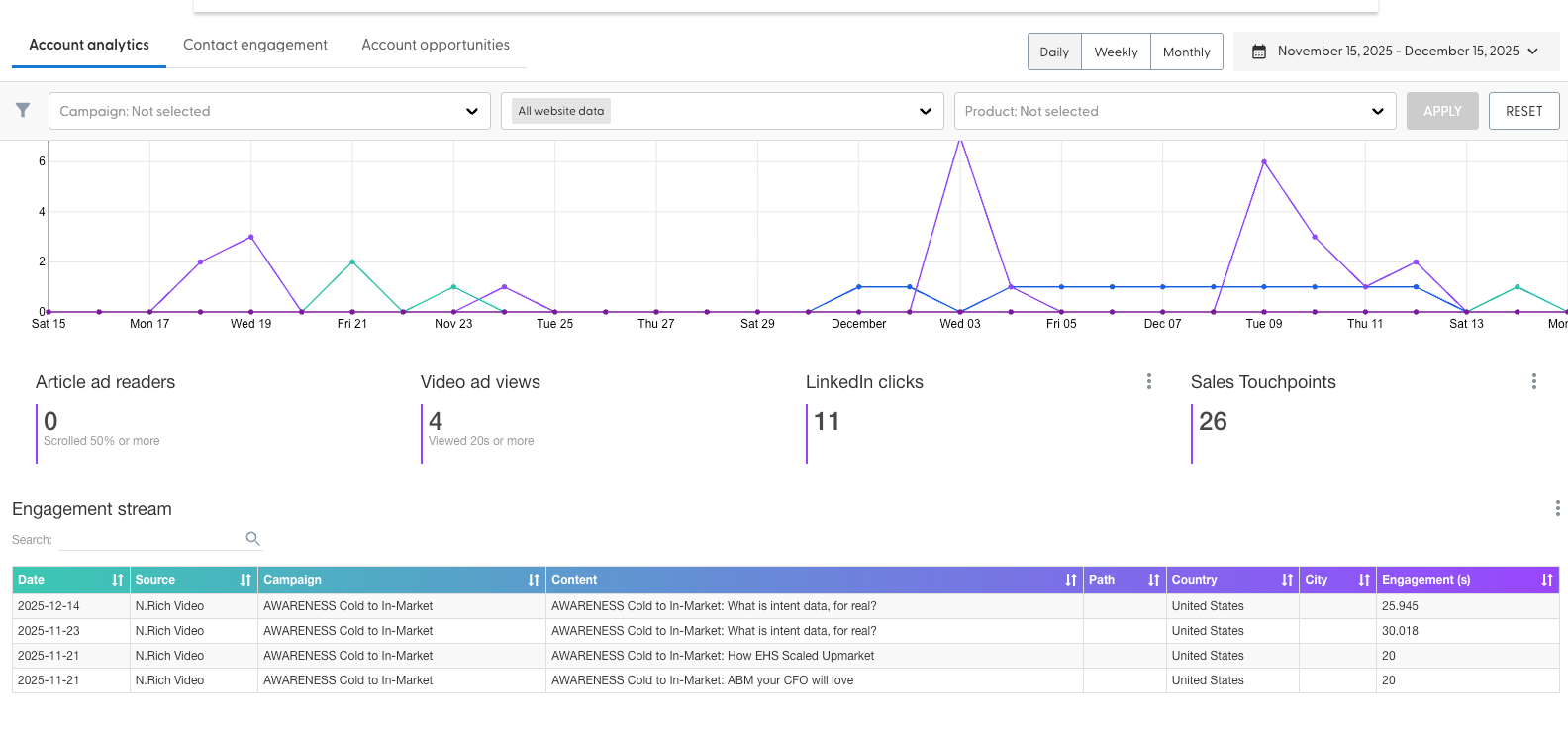

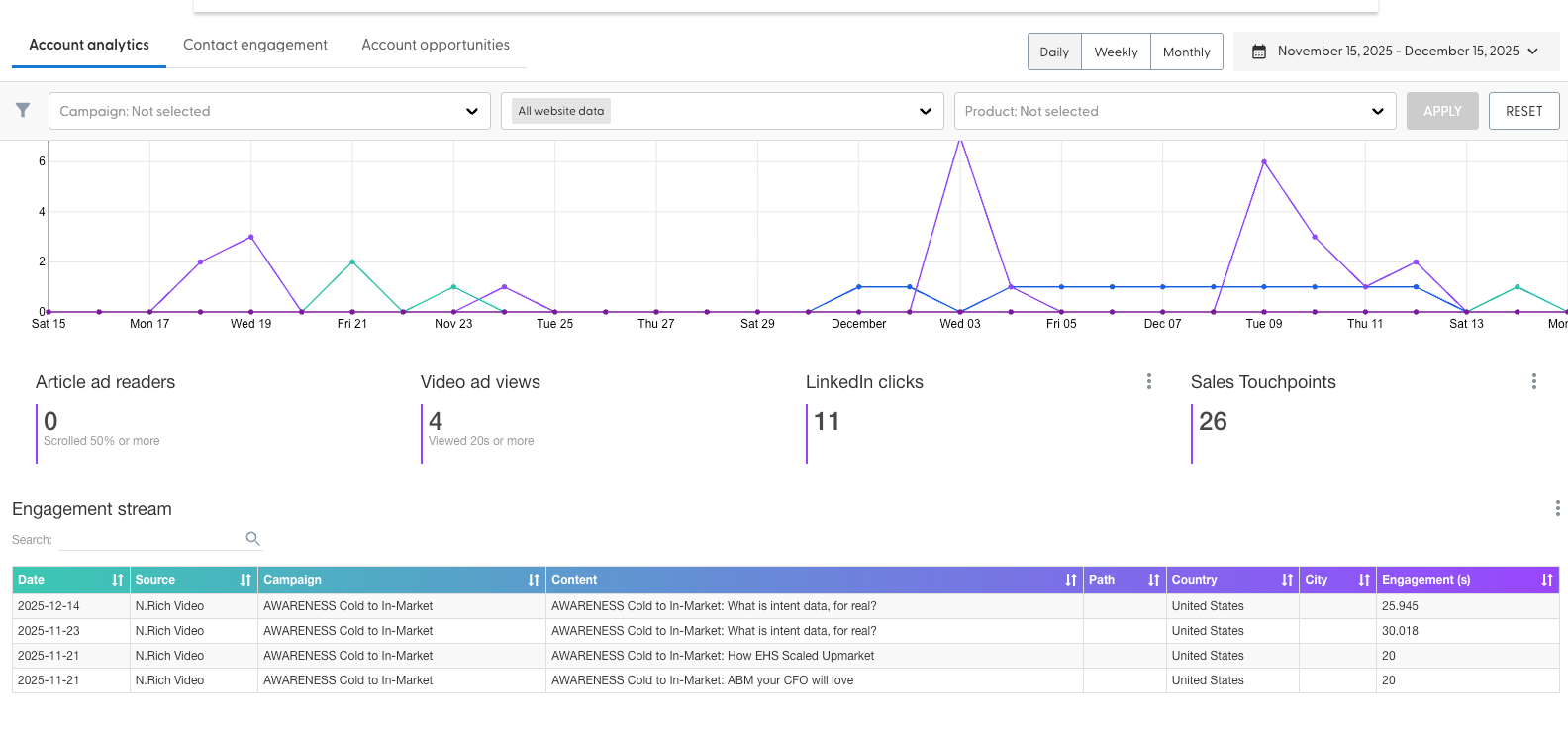

A recent example from our own Slack: marketing content engagement led to a meeting booked - within 5 hours after the content asset was published.

(Show this to your colleague that has been telling you “people don’t agree to do a demo just because they downloaded a PDF)

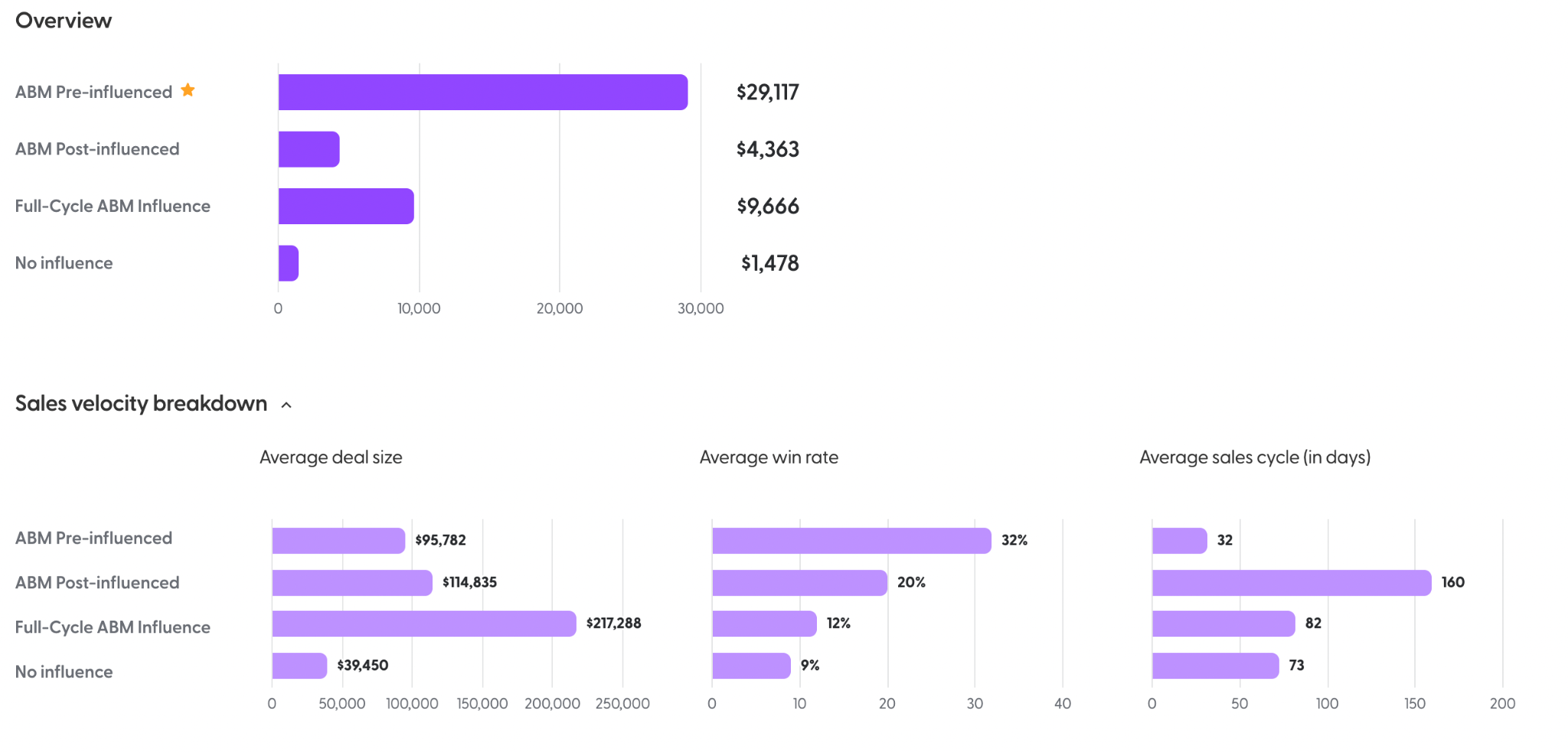

3. Revenue outcomes: showing how ABM improves win rates, deal size, and sales cycle

Revenue outcomes are where ABM earns its place in the executive conversation. At the C-Suite level, nothing matters more than how ABM shapes the economic profile of the business. This includes win rates, average contract value, expansion velocity, sales cycle length, and Tier 1 penetration.

The State of ABM 2025 data shows a clear maturity gap here: only 36% of organizations measure ABM ROI, only 38% measure deal size, and only 22% track expansion. This is the main reason ABM remains undervalued in many companies. Marketing is doing the work but it does not show results in the financial terms the C-Suite expects.

Practically, revenue outcomes show up in the deals your exec team congratulates internally. A win from a Tier 1 account because the buying committee had been engaging with content for eight months before the first sales call. A shortened sales cycle because ABM nurtured the account long before the SDR outreach. A larger deal size because multiple stakeholders had already consumed product-specific content. These are the narratives that resonate in board decks, annual planning meetings, and QBRs.

When marketing brings these journey-based revenue stories tied to clear data, executives stop asking whether ABM is working. They start asking how to scale it.

How to Operationalize This Model with N.Rich

While ABM strategy succeeds or fails based on leadership discipline, execution still requires infrastructure that supports alignment, precision, and measurement. This is where N.Rich becomes a practical enabler of day-to-day ABM.

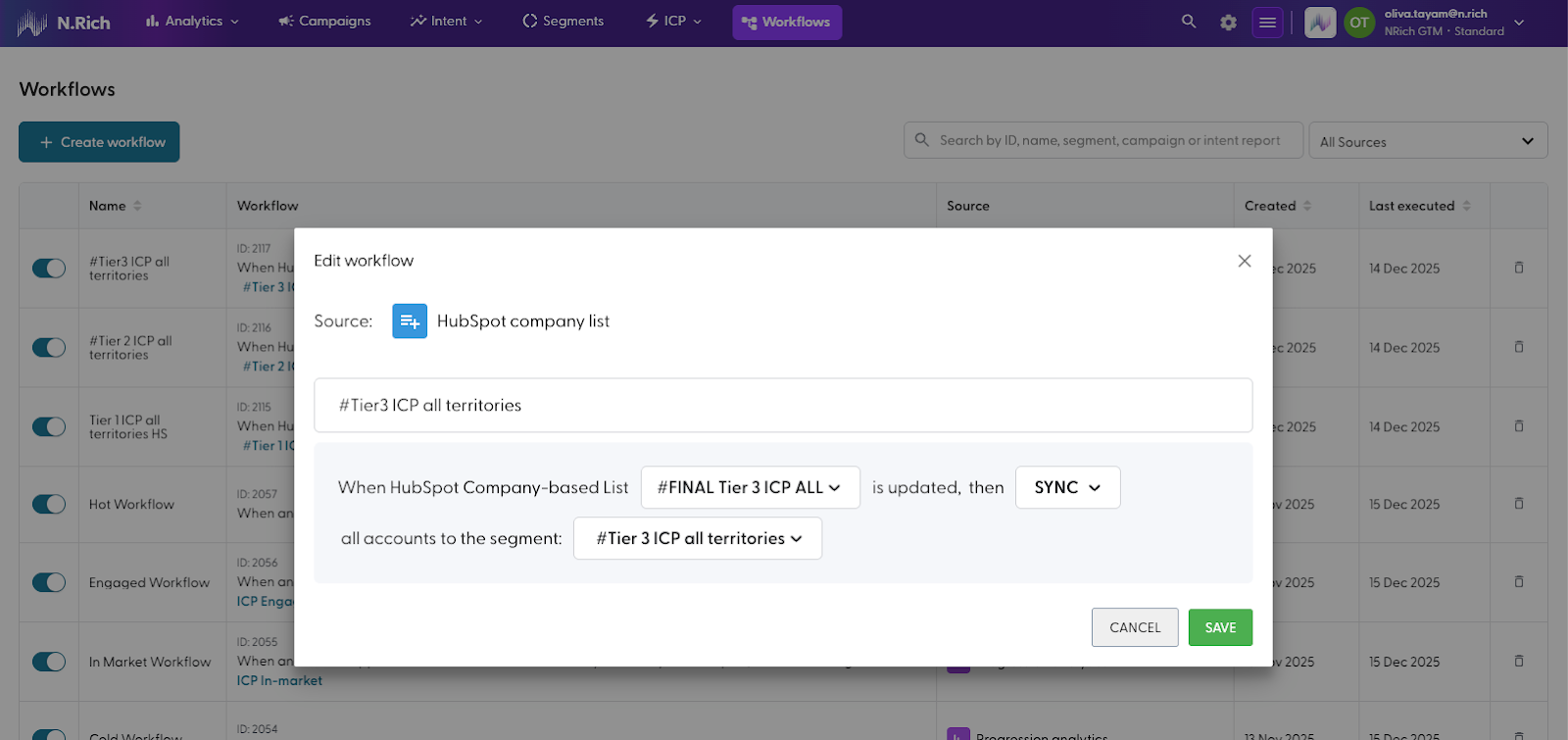

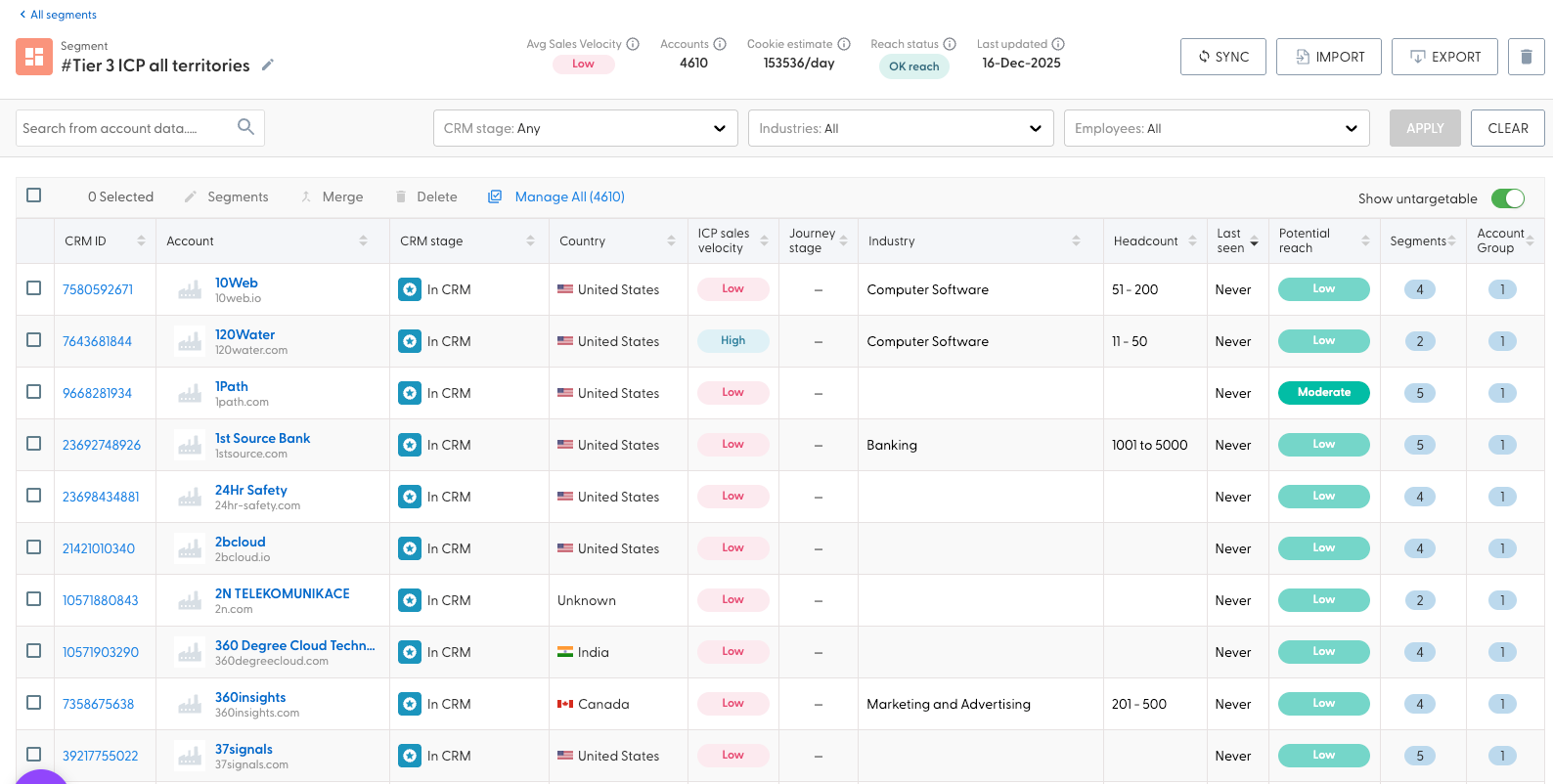

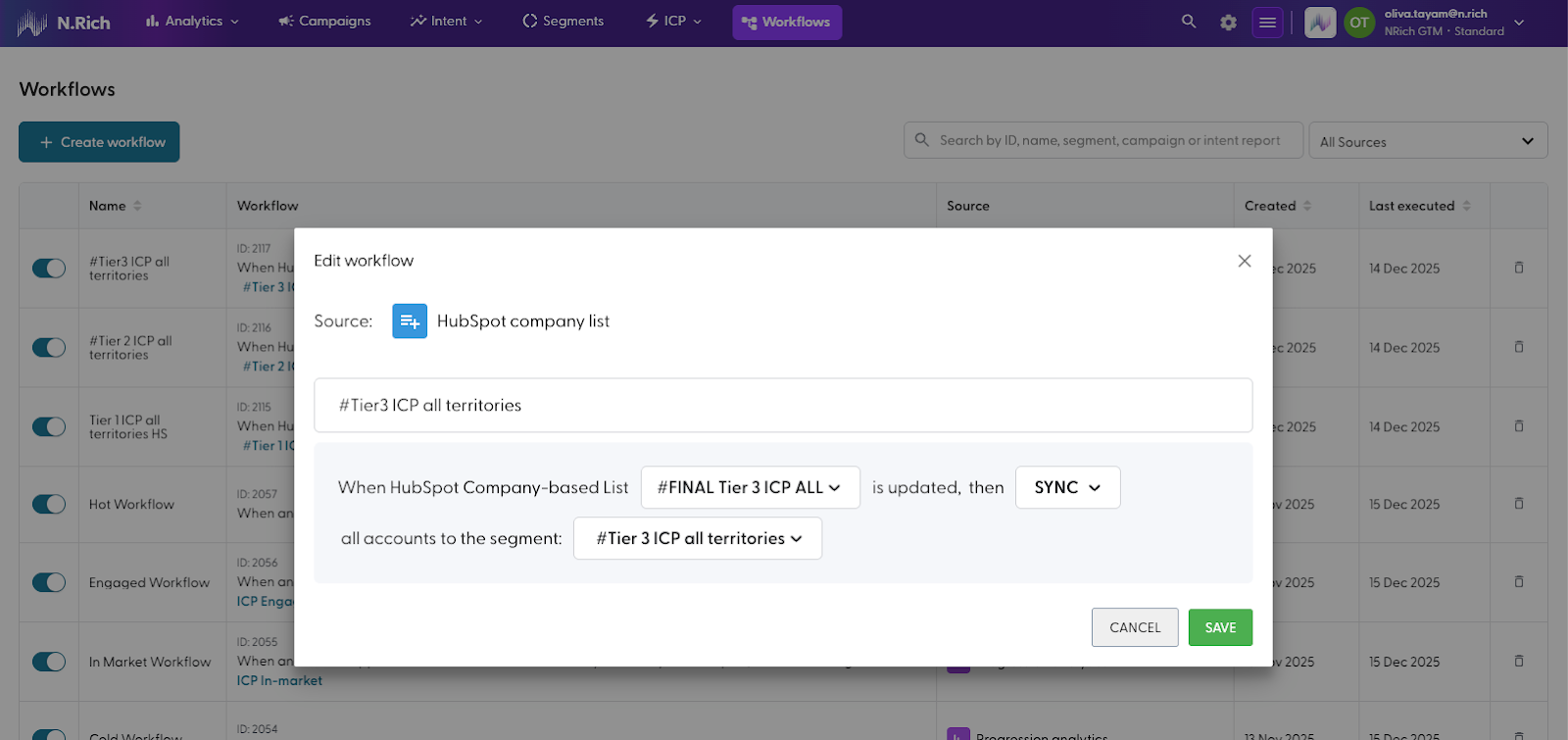

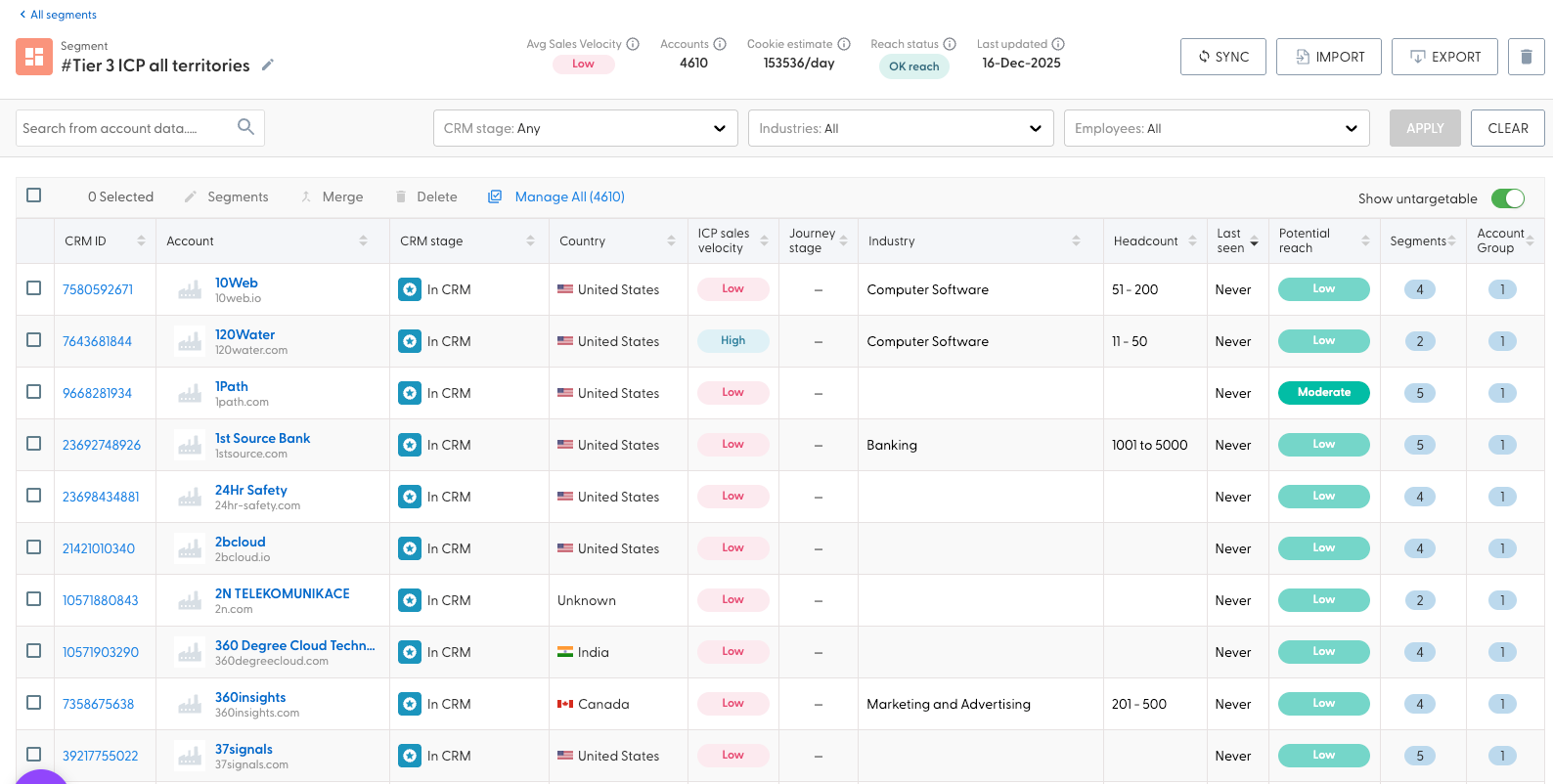

1. CRM-Synced ICP Segments

Instead of static spreadsheets, N.Rich turns ICP tiers into dynamic segments that update automatically from CRM fields. This removes daily friction. No more outdated targeting, no more last-minute list corrections, and no more misalignment between Marketing and Sales.

2. Unified account timelines used across the GTM team

Marketing, Sales, and SDRs operate from the same account-level timeline containing website engagement, display interactions, LinkedIn behavior, SDR touches, AE activity, and opportunity progression. Teams use this in daily standups, weekly pipeline reviews, and account planning sessions.

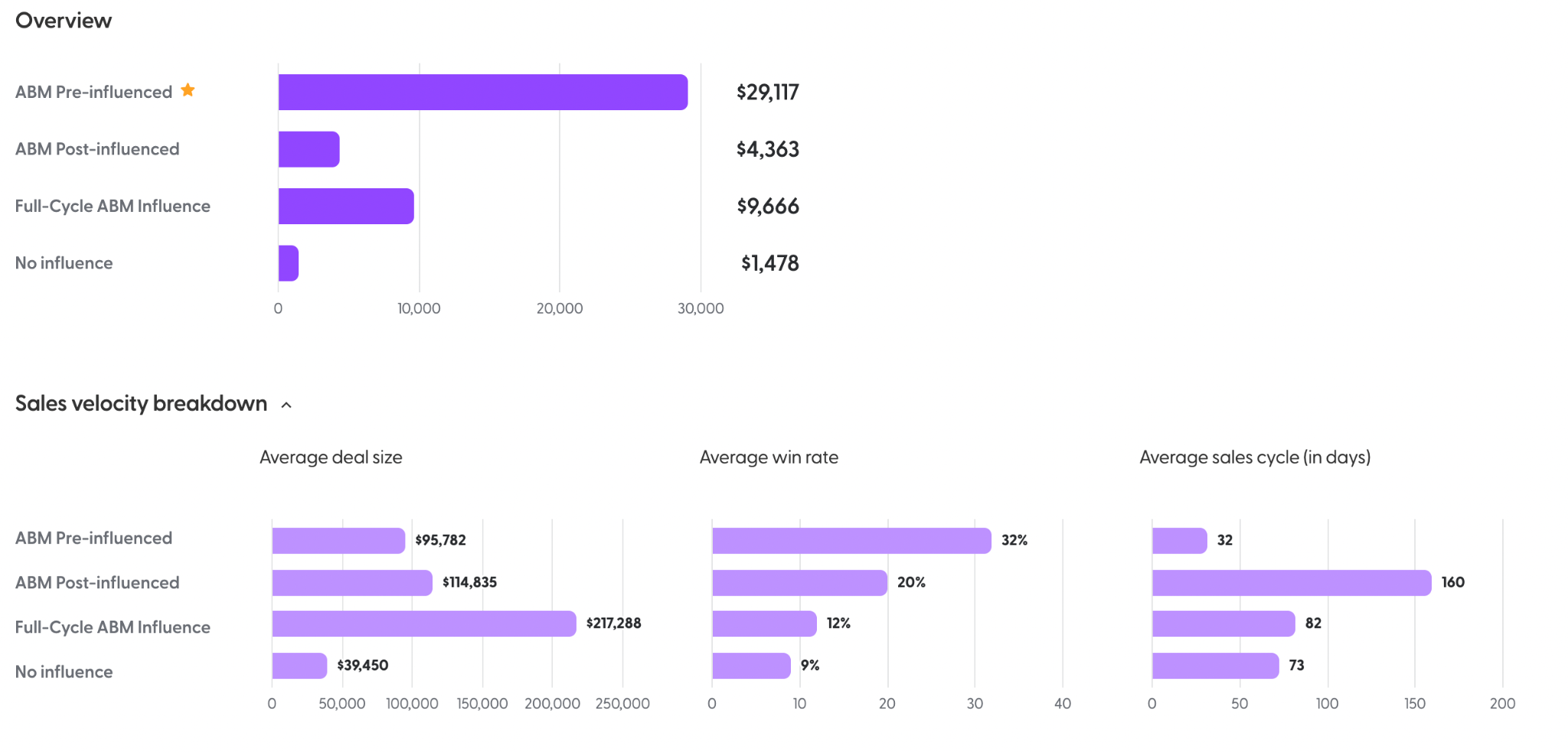

3. Revenue-impact measurement through the Sales Velocity dashboard

Leaders can instantly compare warm vs. cold accounts across:

- Opportunity creation

- Win rates

- Sales cycle

- Deal size

This transforms executive conversations. Marketing no longer reports activity. It reports commercial impact. When ABM is communicated this way, marketing moves from a cost center to a strategic engine. One tied directly to growth, deal quality, and predictable revenue across regions. ABM becomes not just a marketing program, but a GTM operating model the C-Suite can trust and scale.

To see this measurement framework applied in real workflows, watch the webinar “How N.Rich Is Saving Me as a Marketer in a Sales-Led Org.”

If you want the macro trends behind the strategy, download the State of ABM Report.

.webp)