What is the total addressable market for your product or service?

If you're not sure, don't worry, you're not alone.

A relatively small number of business owners understand what the Total Addressable Market (TAM) is or how to calculate it. Whether you're in the startup stage or well past it, understanding TAM can help you make more informed decisions about launching new products, entering new markets, future growth, and the fate of existing products.

Sounds like something you could use in your business?

Keep reading to learn everything you need to know about the Total Addressable Market, including its definition, how to calculate it, and what role it plays in business.

What is the total addressable market?

The Total Addressable Market is the revenue opportunity available for a specific product or service in a given market if 100% of the market were captured.

In other words, TAM is how much money you would make if you could sell your product or service to everyone in your target market.

To better understand this concept, let's look at one very simple example.

Say you own a SaaS company that sells project management software. Your total addressable market would be the revenue you could generate if you could sell your software to every single business that needs project management software.

Of course, you're not going to achieve 100% market share (nobody does!).

But, understanding your TAM can help you:

- Make informed decisions about new products or services

- Assess the potential of new markets

- Understand your growth potential

- Set realistic goals and financial projections

- Make decisions about the fate of existing products

- Asses the efforts and resources required to capture a specific portion of the market

All of these insights are valuable to any business owner, whether you're just starting out or you've been in business for years.

What's also important to mention here is that investors are particularly interested in this metric as it provides them with an understanding of the risks and potential rewards associated with investing in a company.

For example, a company with a large TAM but a small market share is often seen as having more upside potential than a company with a small TAM and a large market share.

Now before we go dive into how to calculate TAM, it's important to take a look at 3 mistakes business owners often make when trying to define it.

3 Mistakes Businesses Make When Defining TAM

Defining your TAM is not always a straightforward task. In fact, it's easy to make some common mistakes that can lead to an inaccurate understanding of your TAM.

Here are 3 of the most common mistakes businesses make:

1. Mixing up TAM, SAM, and SOM

The Total Addressable Market is often confused with the Serviceable Available Market (SAM) and the Serviceable Obtainable Market (SOM).

It's important to understand the difference between these three concepts so you can avoid making this mistake in your own business.

The Serviceable Available Market (SAM) is the portion of the TAM that is accessible to a company given its current resources and capabilities.

To better understand this, let's look at our project management software example from earlier.

Let's say that your project management software is only available in English and can only be used by businesses with fewer than 30 employees.

This would mean that your SAM is the portion of the TAM that is accessible to you given these limitations. In other words, your SAM would be the portion of the market that is made up of English-speaking businesses with fewer than 30 employees.

The Serviceable Obtainable Market (SOM) is the portion of the SAM that a company can realistically capture. SOM will always be smaller than SAM as it takes into account things like competition, pricing, existing demand, your product or service, etc.

Going back to our previous example, if we assume that there are already 5 established competitors in the market, that your software is priced at the high end, and that there is little existing demand for your product (most of them are already using one of the 5 established competitors) then your SOM would be low, cause just by these 3 factors alone, it would be very hard to capture a significant portion of the market.

2. Not segmenting the market

Another common mistake businesses make when trying to define their TAM is not segmenting the market.

The total addressable market for a specific product or service will always be much larger than the market for that product or service within a specific segment.

For example, the total addressable market for project management software is the entire global market for software that helps businesses manage their projects.

But the market for project management software specifically for small businesses in the United States is much smaller. And the market for project management software specifically for small businesses in the United States that are in the construction industry is even smaller.

By segmenting the market, you can get a much more accurate understanding of the market size you're actually targeting and the business opportunities that exist within that market.

3. Not taking into account future growth

When trying to define their TAM, many businesses make the mistake of only considering the present moment and not taking into account future growth.

For example, let's say that your project management software is currently only used by businesses with fewer than 30 employees and it's only available in English.

If you only consider the portion of the TAM that is accessible to you given these limitations, then you're not considering the future growth of your business.

In order to get a more accurate understanding of your TAM, you need to take into account things like your plans for expanding your product or service to new markets, adding new features that will make it accessible to a wider range of businesses, etc.

Defining TAM The Right Way

Alright, now that you know what not to do when defining your TAM, let's take a look at the right way to go about it.

When it comes to defining your TAM, there are 2 approaches you can take: the top-down approach and the bottom-up approach.

Top-Down Approach

The top-down approach to defining your TAM starts with estimating the size of the overall market for your product or service and then narrowing it down to the portion of that market that applies to your business.

The process looks something like this:

- Estimate the size of the overall market for your product or service.

- Segment the market to identify the portion of that market that is relevant to your business.

- Estimate the size of the relevant portion of the market.

- If needed, segment the market further to get an even more accurate estimate of your TAM.

If you didn't notice, this is the approach we've been using so far in this post.

For example, when we looked at the TAM for project management software, we started with the overall market for project management software and then segmented it down to project management software specifically for small businesses in the United States with fewer than 30 employees and that are in the construction industry.

The top-down approach is best suited for businesses that are just starting out or that are entering a new market because it gives you a broad understanding of the opportunity that exists.

It's also relatively easy to do because you can estimate the size of the overall market for your product or service using secondary research.

On the downside, since it heavily relies on data from third-party sources like market research reports, industry association reports, industry data, and research studies, the top-down approach requires a lot of assumptions and can be quite inaccurate.

Bottom-Up Approach

The bottom-up approach to defining your TAM starts with an ideal target market on a small scale and then expanding it out to estimate the overall size of the market.

This could be done by starting with a sample of theoretical customers and then extrapolating that data to estimate the size of the overall market.

However, the better and more common way to do it is by starting with your existing customer base and going from there.

The process looks something like this:

- Identify your ideal customer profile.

- Estimate the number of potential customers that fit your ideal target customer profile.

- Multiply the number of potential customers by the annual contract value (ACV) to get an estimate of the total market opportunity.

The bottom-up approach is great for businesses that have been around for a while and already have a customer base because it allows defining the TAM using data that is accurate and there are fewer assumptions involved.

Another advantage of the bottom-up approach is that it can help you identify opportunities for growth in your existing customer base that you might not have been aware of.

For example, when you start with your current customer base, you might realize that you're only serving a small portion of their needs with your current product offering and that there's an opportunity to upsell or cross-sell them additional products or services.

Or you might realize that you're only serving customers in a certain geographic region or industry and that there's an opportunity to expand into new markets.

The bottom-up approach also has a few disadvantages.

The biggest one is that it can be quite time-consuming and resource-intensive because it requires you to gather data from your existing customers.

Additionally, if you don't have a large enough customer base, the bottom-up approach might not be the best option because you won't have enough data to work with.

Which approach is best for you?

The answer to this question depends on a number of factors, including:

- The stage of your business

- The size of your customer base

- The accuracy of the data you have

- The resources you have available

If you're just starting out, or if you're entering a new market, the top-down approach might be the more suitable option because it will give you a broad understanding of the opportunity that exists.

If you're a more established business with a large customer base, the bottom-up approach might be the better option because you'll be able to define your TAM using data that is more accurate and there are lot fewer assumptions involved.

The best way to define your TAM is to use a combination of both the top-down and bottom-up approaches.

Starting with a broad understanding of the opportunity that exists will give you a good foundation to work from. You can then refine your estimate by starting with your existing customer base and expanding from there. This will give you a more accurate estimate of the TAM for your specific product or service.

TAM Formula

Once you've decided which approach (or combination of approaches) is best for you, it's time to start estimating the size of your TAM.

The most common way to do this is by using the following TAM formula:

TAM = Number of potential customers x ACV

The number of potential customers is the number of people or businesses that fit your ideal target customer profile and the ACV is the average annual contract value that each customer generates.

You Know Your TAM. What’s Next?

Now that you understand what a total addressable market is and how to define it, you might be wondering what now?

Well, there are a couple of things you can do.

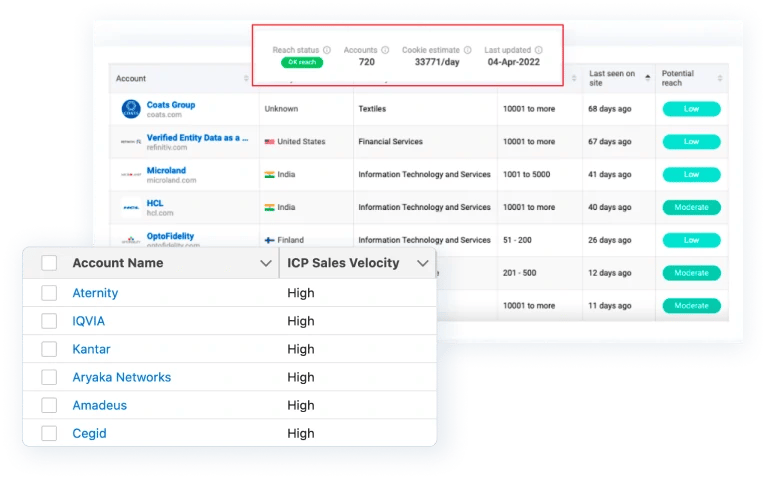

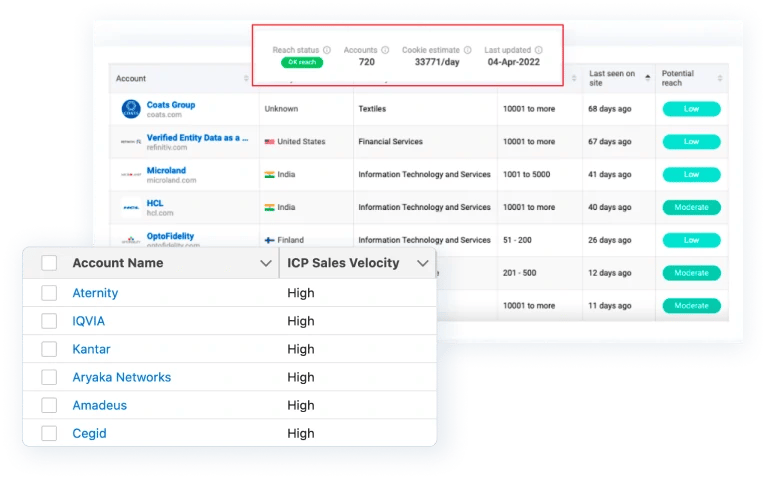

First, you should define your ICP. Your ICP is your ideal customer profile. It's a description of your perfect customer, the company that's the best match for your product or service. Defining your ICP will allow you to focus your marketing and sales efforts on the right companies, which will help you close deals faster and generate more revenue.

Second, build Target Account Lists. Once you know who your ideal customers are, you can start building lists of companies that fit that profile. These lists will be a valuable asset for your sales and marketing teams as they'll know exactly who to target with their efforts.

And lastly, plan a range of account-based campaigns to meet your strategic and tactical goals:

- Brand awareness: Getting your name in front of as many people as possible

- Engagement: Increasing the number of interactions (e.g., website visits, newsletter sign-ups, etc.)

- Pipeline acceleration: Moving more prospects through your sales funnel

- Customer expansion: Upselling and cross-selling to your existing customer base

- Customer retention: Reducing churn and keeping your customers happy

Depending on your goal, you’ll have different criteria for accounts to be in the TAL. Campaigns can be targeted at the entire TAL or a subset.

Executing an account-based marketing strategy will help you close more deals and grow your business. But before you can do that, you need to know your total addressable market. So define your TAM and get started on your path to success.

.webp)